LA "RASSEGNA STAMPA QUOTIDIANA INTERNAZIONALE" (II PARTE)

Tutte le notizie dal "The Sun Daily" (Regno Unito)

____________________________________________________________

Business

U Mobile to roll out various initiatives in Sarawak (Thu, 25 Jul 2024) PETALING JAYA: U Mobile will roll out various initiatives in Sarawak beginning tomorrow, highlighting the telco’s commitment to Sarawakians.

As a start, in line with its East Malaysian expansion strategy, U Mobile will open its first full-service store in Sarawak at Viva City Mall in Kuching this weekend for customers in the state to

enjoy the best of what U Mobile has to offer in terms of customer service as well as the company’s complete suite of products and services, including its latest U Home 5G bundle with Samsung 4K Smart

TVs, supported by Malaysia’s No. 1 5G network at one central location.

To mark the store launch and to make 5G plans even more accessible, the first 250 customers who walk into the store to sign up for a device bundled with U Postpaid Borneo 68, U Postpaid 68 or U

Postpaid 98 will be eligible for rebates of up to RM120, as well as other exciting free gifts (while stocks last). This promotion starts from today (July 26) 26 on a first come, first served

basis.

Chief marketing officer Navin Manian said: “U Mobile believes that our latest U Borneo 5G range is very relevant to Sarawakians. To make it even more convenient for our customers to enjoy our

complete range of products and services, we are delighted to open our first full-service store at Viva City Mall, Kuching. To further promote 5G usage, we are also conducting various trials as well

as on-ground activities, to showcase the full benefits 5G technology can bring to our customers’ everyday lives.”

U Mobile has many plans in the pipeline for Sarawak to support customer experience. The telco revealed that it has increased its site count in Sarawak by over 60% in the last three years. The

population coverage has also increased in the state by 19.5%, bringing U Mobile’s current population coverage in Sarawak to over 81%.

Beyond that, U Mobile is continuously improving connectivity for all Sarawakians as the telco was one of the first to partner with Sarawak Digital Economy Bhd on the Sarawak Multimedia Authority

Rural Telecommunication 600 (SMART600) project, spearheaded by the Sarawak state government, to expedite coverage to Sarawak’s rural population. Through SMART600, U Mobile hosted 4G Multi Operator

Core Network technology on SMART towers, enabling operators to provide 4G service to underserved areas in Sarawak.

Apart from these initiatives, U Mobile is also a Platinum Sponsor for Sukma 2024, happening from Aug 17- 24 in Sarawak. The company will be showcasing innovations in 5G-Advanced at the biennial

national multisport event.

PETALING JAYA: U Mobile will roll out various initiatives in Sarawak beginning tomorrow, highlighting the telco’s commitment to Sarawakians.

As a start, in line with its East Malaysian expansion strategy, U Mobile will open its first full-service store in Sarawak at Viva City Mall in Kuching this weekend for customers in the state to

enjoy the best of what U Mobile has to offer in terms of customer service as well as the company’s complete suite of products and services, including its latest U Home 5G bundle with Samsung 4K Smart

TVs, supported by Malaysia’s No. 1 5G network at one central location.

To mark the store launch and to make 5G plans even more accessible, the first 250 customers who walk into the store to sign up for a device bundled with U Postpaid Borneo 68, U Postpaid 68 or U

Postpaid 98 will be eligible for rebates of up to RM120, as well as other exciting free gifts (while stocks last). This promotion starts from today (July 26) 26 on a first come, first served

basis.

Chief marketing officer Navin Manian said: “U Mobile believes that our latest U Borneo 5G range is very relevant to Sarawakians. To make it even more convenient for our customers to enjoy our

complete range of products and services, we are delighted to open our first full-service store at Viva City Mall, Kuching. To further promote 5G usage, we are also conducting various trials as well

as on-ground activities, to showcase the full benefits 5G technology can bring to our customers’ everyday lives.”

U Mobile has many plans in the pipeline for Sarawak to support customer experience. The telco revealed that it has increased its site count in Sarawak by over 60% in the last three years. The

population coverage has also increased in the state by 19.5%, bringing U Mobile’s current population coverage in Sarawak to over 81%.

Beyond that, U Mobile is continuously improving connectivity for all Sarawakians as the telco was one of the first to partner with Sarawak Digital Economy Bhd on the Sarawak Multimedia Authority

Rural Telecommunication 600 (SMART600) project, spearheaded by the Sarawak state government, to expedite coverage to Sarawak’s rural population. Through SMART600, U Mobile hosted 4G Multi Operator

Core Network technology on SMART towers, enabling operators to provide 4G service to underserved areas in Sarawak.

Apart from these initiatives, U Mobile is also a Platinum Sponsor for Sukma 2024, happening from Aug 17- 24 in Sarawak. The company will be showcasing innovations in 5G-Advanced at the biennial

national multisport event.

>> Continua a leggere

Nestle Malaysia H1 results: Strong market leadership maintained (gio, 25 lug 2024)

PETALING JAYA: Against a background defined by constrained purchasing power, subdued consumer sentiment and cautious spending throughout the Chinese New Year and Hari Raya festive seasons,

Nestlé Malaysia sales reached RM3.3 billion for the first half of 2024 (H1), a correction of 8% versus the historically high record sales achieved for the first half of 2023. The cumulated sales are

on par with the very solid sales achieved in the first half of 2022. Meanwhile, sales for the second quarter ended June 30, 2024 reached RM1.52 billion, down from RM1.75 billion achieved in the

equivalent period of 2023.

Nestlé (Malaysia) Berhad CEO, Juan Aranols said: “The current environment continues to reflect subdued consumer sentiment and constrained purchasing power impacted particularly by the cumulated

inflation in food and other basic items. We recognise the significant challenges this represents for Malaysian families.”

At Nestlé Malaysia, he added they remain focused on providing solid value propositions across their brands and products that meet the expectations of Malaysians.

“We continue to work tirelessly to improve the nutritional profile of our products and testament to this is, as an example, the Healthier Choice Logo for Milo by the Ministry of Health. We have

also brought to market a number of relevant innovations such as Kit Kat Dark Borneo, made with cocoa beans from Sabah and Sarawak, sourced via our Nestlé Borneo Cocoa initiative, in partnership with

the Malaysian Cocoa Board,” he said.

Profitability for the quarter and for the half year, while contracting versus the high baseline periods of comparison in 2023, remained at a healthy level, with H1 Profit Before Tax at RM385

million and H1 Profit After Tax at RM289.1 million, allowing the Company to declare a first interim dividend payment of RM0.70 per share, the same level as the prior year.

When commenting on the profitability evolution for H1, Aranols said, “We recognise the significant challenges that high food costs, driven by the global situation of commodity prices, create for

Malaysian families. That is why we continue to make every possible effort to moderate the translation to our final prices of these external cost increases, absorbing them to the best of our ability

and mitigating cost pressure through all possible actions, including the constant search for internal process efficiencies and the adoption of digital-enabled technologies across our entire value

chain.”

Looking ahead, he said they expect challenging conditions to remain throughout the third quarter and moderate progressively towards the end of the year, with a return to growth latest by H1

2025.

PETALING JAYA: Against a background defined by constrained purchasing power, subdued consumer sentiment and cautious spending throughout the Chinese New Year and Hari Raya festive seasons,

Nestlé Malaysia sales reached RM3.3 billion for the first half of 2024 (H1), a correction of 8% versus the historically high record sales achieved for the first half of 2023. The cumulated sales are

on par with the very solid sales achieved in the first half of 2022. Meanwhile, sales for the second quarter ended June 30, 2024 reached RM1.52 billion, down from RM1.75 billion achieved in the

equivalent period of 2023.

Nestlé (Malaysia) Berhad CEO, Juan Aranols said: “The current environment continues to reflect subdued consumer sentiment and constrained purchasing power impacted particularly by the cumulated

inflation in food and other basic items. We recognise the significant challenges this represents for Malaysian families.”

At Nestlé Malaysia, he added they remain focused on providing solid value propositions across their brands and products that meet the expectations of Malaysians.

“We continue to work tirelessly to improve the nutritional profile of our products and testament to this is, as an example, the Healthier Choice Logo for Milo by the Ministry of Health. We have

also brought to market a number of relevant innovations such as Kit Kat Dark Borneo, made with cocoa beans from Sabah and Sarawak, sourced via our Nestlé Borneo Cocoa initiative, in partnership with

the Malaysian Cocoa Board,” he said.

Profitability for the quarter and for the half year, while contracting versus the high baseline periods of comparison in 2023, remained at a healthy level, with H1 Profit Before Tax at RM385

million and H1 Profit After Tax at RM289.1 million, allowing the Company to declare a first interim dividend payment of RM0.70 per share, the same level as the prior year.

When commenting on the profitability evolution for H1, Aranols said, “We recognise the significant challenges that high food costs, driven by the global situation of commodity prices, create for

Malaysian families. That is why we continue to make every possible effort to moderate the translation to our final prices of these external cost increases, absorbing them to the best of our ability

and mitigating cost pressure through all possible actions, including the constant search for internal process efficiencies and the adoption of digital-enabled technologies across our entire value

chain.”

Looking ahead, he said they expect challenging conditions to remain throughout the third quarter and moderate progressively towards the end of the year, with a return to growth latest by H1

2025.

>> Continua a leggere

Miti targets eightfold increase in value of green investments (gio, 25 lug 2024)

KUALA LUMPUR: The Ministry of Investment, Trade and Industry (Miti) aims to attract about eight times the current value of green investments into Malaysia and stimulate socio-economic

growth.

Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz said that in the current global race to net-zero, this aligns with the responsibility of Miti as the main coordinating and implementing Ministry

for the Green Investment Strategy (GIS).

“The GIS will complement existing policies such as New Industrial Master Plan 2030, the National Energy Transition Roadmap and National Industry ESG Framework,” he said in his keynote speech at

the 8th Selangor Asean Business Conference 2024 (SABC 2024) today.

He added that Selangor will benefit from this in terms of new business opportunities for SMEs, and skills development for Selangorians in the green industry.

In 2023, Tengku Zafrul said, Malaysia recorded a 23% increase in approved investments, to the tune of RM329.5 billion, with Selangor receiving more than RM55 billion. “This growth is partly

attributed to Asean’s firm stance on its neutrality and independence, which attracted RM654.1 billion (US$155 billion) of foreign direct investments.”

Tengku Zafrul said Selangor’s first-quarter 2024 approved investments of RM12.4 billion make it one of the biggest investment contributors to Malaysia’s Q1’24 investments, which solidifies

Selangor’s rank as Malaysia’s leading hub for innovation and economic growth.

“This paves the way for Selangor to leverage Asean’s position as the world’s current ‘darling destination’ for investments in manufacturing,” he remarked.

For digital transformation, Tengku Zafrul said the creation of data centres in Malaysia would generate economic benefits and have a significant multiplier effect on job creation.

“For instance, Google recently announced an investment of RM9.4 billion, with the economic benefits expected to double to RM15 billion and generate over 20,000 job opportunities. Although the

direct job impact might not be extensive, the arrival of major tech companies and the establishment of data centres can be compared to constructing a ‘highway,’ which will facilitate the entry of

other businesses into Malaysia.”

On a separate issue, Tengku Zafrul said the Asean Digital Economy Framework (Defa), currently under negotiation, is likely to be completed during the Asean Summit next year.

Intratrade within Asean currently stands at 20%, he added, and Defa is expected to boost trade between member states, particularly for SMEs.

Tengku Zafrul said that a way to increase Asean’s intratrade is through increasing digital e-commerce and this would help SMEs.

Meanwhile, Selangor International Business Summit 2024 officially kicked off yesterday, marking the start of its first series with SABC 2024 and the Selangor Investment and Industrial Park Expo

2024, being held at the Kuala Lumpur Convention Centre until tomorrow.

The launch of SABC 2024 was officiated by Selangor Menteri Besar Datuk Seri Amirudin Shari. The event spans two days and features 20 distinguished speakers from 10 countries, including Singapore,

Indonesia, the Philippines, Vietnam, Laos, Cambodia, Brunei, Timor-Leste and Malaysia, and from the European Union, and is hosting 200 international delegates from 23 countries.

KUALA LUMPUR: The Ministry of Investment, Trade and Industry (Miti) aims to attract about eight times the current value of green investments into Malaysia and stimulate socio-economic

growth.

Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz said that in the current global race to net-zero, this aligns with the responsibility of Miti as the main coordinating and implementing Ministry

for the Green Investment Strategy (GIS).

“The GIS will complement existing policies such as New Industrial Master Plan 2030, the National Energy Transition Roadmap and National Industry ESG Framework,” he said in his keynote speech at

the 8th Selangor Asean Business Conference 2024 (SABC 2024) today.

He added that Selangor will benefit from this in terms of new business opportunities for SMEs, and skills development for Selangorians in the green industry.

In 2023, Tengku Zafrul said, Malaysia recorded a 23% increase in approved investments, to the tune of RM329.5 billion, with Selangor receiving more than RM55 billion. “This growth is partly

attributed to Asean’s firm stance on its neutrality and independence, which attracted RM654.1 billion (US$155 billion) of foreign direct investments.”

Tengku Zafrul said Selangor’s first-quarter 2024 approved investments of RM12.4 billion make it one of the biggest investment contributors to Malaysia’s Q1’24 investments, which solidifies

Selangor’s rank as Malaysia’s leading hub for innovation and economic growth.

“This paves the way for Selangor to leverage Asean’s position as the world’s current ‘darling destination’ for investments in manufacturing,” he remarked.

For digital transformation, Tengku Zafrul said the creation of data centres in Malaysia would generate economic benefits and have a significant multiplier effect on job creation.

“For instance, Google recently announced an investment of RM9.4 billion, with the economic benefits expected to double to RM15 billion and generate over 20,000 job opportunities. Although the

direct job impact might not be extensive, the arrival of major tech companies and the establishment of data centres can be compared to constructing a ‘highway,’ which will facilitate the entry of

other businesses into Malaysia.”

On a separate issue, Tengku Zafrul said the Asean Digital Economy Framework (Defa), currently under negotiation, is likely to be completed during the Asean Summit next year.

Intratrade within Asean currently stands at 20%, he added, and Defa is expected to boost trade between member states, particularly for SMEs.

Tengku Zafrul said that a way to increase Asean’s intratrade is through increasing digital e-commerce and this would help SMEs.

Meanwhile, Selangor International Business Summit 2024 officially kicked off yesterday, marking the start of its first series with SABC 2024 and the Selangor Investment and Industrial Park Expo

2024, being held at the Kuala Lumpur Convention Centre until tomorrow.

The launch of SABC 2024 was officiated by Selangor Menteri Besar Datuk Seri Amirudin Shari. The event spans two days and features 20 distinguished speakers from 10 countries, including Singapore,

Indonesia, the Philippines, Vietnam, Laos, Cambodia, Brunei, Timor-Leste and Malaysia, and from the European Union, and is hosting 200 international delegates from 23 countries.

>> Continua a leggere

InvestKL secures RM3.3 billion in investments in first half of 2024. (gio, 25 lug 2024)

PETALING JAYA: InvestKL has secured RM3.3 billion in investments, creating 3,389 high-value regional jobs through the establishment of six global services hubs in the first half of

2024.

The investments, secured amid global challenges, reaffirm Greater Kuala Lumpur’s (Greater KL) appeal as a top investment destination, bolstered by the country’s ease of doing business, robust

infrastructure, skilled talent pool, and vibrant ecosystem driven by collaboration and innovation.

Malaysia recorded an impressive first-quarter 2024 investment progress of RM83.7 billion, a 13% increase over the same period last year, of which 47% (RM39.3 billion) are from the services sector,

marking a shift towards service-oriented investments.

Reflecting these results, InvestKL’s new investments include the establishment of a data centre by a global data centre and co-location provider from the US; a centre of excellence by a largest

premium label and packaging provider from the US: a global operation centre by a provider of integrated software solutions from the UK; an Apac global business services hub by the UK’s global

recruitment company; an EPCI execution centre by an offshore energy solutions company from Japan and a digital lab headquarters by Singapore’s foremost telecommunication provider of innovative

technologies and sustainable solutions.

InvestKL CEO Datuk Muhammad Azmi Zulkifli said in a statement, “The first-half results demonstrate InvestKL’s continued impact in solidifying Greater KL’s status as a top investment destination in

the region. This aligns well with our 2024 target to attract global services hubs with a focus on technology and cutting-edge activities that will spur high-skilled jobs for Malaysians. Through our

engagements, it is evident that more eyes are now on Malaysia, and global companies are eager to capitalise on the country’s strength to deepen their investments and broaden their regional presence

from Greater KL.”

As of today, InvestKL has attracted more than 140 global services hubs by leading companies employing more than 27,000 executives with an average monthly salary of RM17,000. InvestKL’s strategic

direction will focus on attracting global services from key sectors such as digital and technology, engineering, health tech, and renewable energy, while also emphasising human capital

development.

PETALING JAYA: InvestKL has secured RM3.3 billion in investments, creating 3,389 high-value regional jobs through the establishment of six global services hubs in the first half of

2024.

The investments, secured amid global challenges, reaffirm Greater Kuala Lumpur’s (Greater KL) appeal as a top investment destination, bolstered by the country’s ease of doing business, robust

infrastructure, skilled talent pool, and vibrant ecosystem driven by collaboration and innovation.

Malaysia recorded an impressive first-quarter 2024 investment progress of RM83.7 billion, a 13% increase over the same period last year, of which 47% (RM39.3 billion) are from the services sector,

marking a shift towards service-oriented investments.

Reflecting these results, InvestKL’s new investments include the establishment of a data centre by a global data centre and co-location provider from the US; a centre of excellence by a largest

premium label and packaging provider from the US: a global operation centre by a provider of integrated software solutions from the UK; an Apac global business services hub by the UK’s global

recruitment company; an EPCI execution centre by an offshore energy solutions company from Japan and a digital lab headquarters by Singapore’s foremost telecommunication provider of innovative

technologies and sustainable solutions.

InvestKL CEO Datuk Muhammad Azmi Zulkifli said in a statement, “The first-half results demonstrate InvestKL’s continued impact in solidifying Greater KL’s status as a top investment destination in

the region. This aligns well with our 2024 target to attract global services hubs with a focus on technology and cutting-edge activities that will spur high-skilled jobs for Malaysians. Through our

engagements, it is evident that more eyes are now on Malaysia, and global companies are eager to capitalise on the country’s strength to deepen their investments and broaden their regional presence

from Greater KL.”

As of today, InvestKL has attracted more than 140 global services hubs by leading companies employing more than 27,000 executives with an average monthly salary of RM17,000. InvestKL’s strategic

direction will focus on attracting global services from key sectors such as digital and technology, engineering, health tech, and renewable energy, while also emphasising human capital

development.

>> Continua a leggere

TM, Singtel’s Nxera break ground for state-of-the-art, AI-ready data centre campus in Johor (gio, 25 lug 2024)

PETALING JAYA: Telekom Malaysia Bhd (TM) and Nxera, the regional data centre arm of Singtel’s Digital InfraCo unit, held a groundbreaking ceremony today for their 64MW state-of-the-art,

sustainable, hyper-connected, artificial intelligence-ready data centre campus in Iskandar Puteri, Johor

The groundbreaking comes one month after the announcement for a joint venture to develop data centres in Malaysia and uplift Johor’s digital hub status.

Digital Minister Gobind Singh Deo said, “This investment by TM and Nxera reinforces Malaysia’s position as the digital hub in Southeast Asia, further advancing the nation’s economic growth. Based

on advance estimates, Malaysia’s economy expanded 5.8% in the second quarter of 2024, and such investments are in line with projections that Malaysia’s digital economy will contribute 25.5% to the

nation’s GDP by the end of the year.

“The relationship between TM and Nxera expands to Malaysia and Singapore, with both nations being a good case study of a productive working partnership between two Asean member states.”

Johor Menteri Besar Datuk Onn Hafiz Ghazi said TM-Nxera’s upcoming data centre campus, located in Iskandar Puteri, holds particular significance as one of the Johor Singapore Special Economic

Zone’s first investment projects.

This data centre campus, he added, will serve as a catalyst for economic growth and enable businesses to harness the power of cloud computing and AI.

“We hope this will set the stage to shape a vibrant business ecosystem where more high-tech and high-value content companies will be attracted to locate their operations within the special

economic zone and give a further boost to Johor’s digital economy, said Onn Hafiz.

TM Group CEO Amar Huzaimi Md Deris said the facility exemplifies their commitment to fostering industry growth, driving innovation, and enhancing socio-economic development. “With support from the

Federal Government, and Johor state agencies and authorities, we are confident that this AI-ready data centre will equip businesses with unparalleled computing power, AI capabilities, and other

cutting-edge technologies.”

Meanwhile, Nxera and Singtel’s Digital InfraCo unit CEO Bill Chang said that as one of the largest investments in the Johor-Singapore Special Economic Zone, this state-of-the-art data centre

campus is an integral part of their mission to empower digital economies and communities in the region while ensuring energy and water resources are deployed responsibly and efficiently.

Scheduled to begin commercial operations in 2026, the cloud-enabled Tier 3 data centre campus will use liquid cooling to handle higher power density AI workloads. The facility will be designed,

built and certified to Leadership in Energy and Environmental Design standards, incorporating energy and water-efficient solutions to optimise the use of resources.

PETALING JAYA: Telekom Malaysia Bhd (TM) and Nxera, the regional data centre arm of Singtel’s Digital InfraCo unit, held a groundbreaking ceremony today for their 64MW state-of-the-art,

sustainable, hyper-connected, artificial intelligence-ready data centre campus in Iskandar Puteri, Johor

The groundbreaking comes one month after the announcement for a joint venture to develop data centres in Malaysia and uplift Johor’s digital hub status.

Digital Minister Gobind Singh Deo said, “This investment by TM and Nxera reinforces Malaysia’s position as the digital hub in Southeast Asia, further advancing the nation’s economic growth. Based

on advance estimates, Malaysia’s economy expanded 5.8% in the second quarter of 2024, and such investments are in line with projections that Malaysia’s digital economy will contribute 25.5% to the

nation’s GDP by the end of the year.

“The relationship between TM and Nxera expands to Malaysia and Singapore, with both nations being a good case study of a productive working partnership between two Asean member states.”

Johor Menteri Besar Datuk Onn Hafiz Ghazi said TM-Nxera’s upcoming data centre campus, located in Iskandar Puteri, holds particular significance as one of the Johor Singapore Special Economic

Zone’s first investment projects.

This data centre campus, he added, will serve as a catalyst for economic growth and enable businesses to harness the power of cloud computing and AI.

“We hope this will set the stage to shape a vibrant business ecosystem where more high-tech and high-value content companies will be attracted to locate their operations within the special

economic zone and give a further boost to Johor’s digital economy, said Onn Hafiz.

TM Group CEO Amar Huzaimi Md Deris said the facility exemplifies their commitment to fostering industry growth, driving innovation, and enhancing socio-economic development. “With support from the

Federal Government, and Johor state agencies and authorities, we are confident that this AI-ready data centre will equip businesses with unparalleled computing power, AI capabilities, and other

cutting-edge technologies.”

Meanwhile, Nxera and Singtel’s Digital InfraCo unit CEO Bill Chang said that as one of the largest investments in the Johor-Singapore Special Economic Zone, this state-of-the-art data centre

campus is an integral part of their mission to empower digital economies and communities in the region while ensuring energy and water resources are deployed responsibly and efficiently.

Scheduled to begin commercial operations in 2026, the cloud-enabled Tier 3 data centre campus will use liquid cooling to handle higher power density AI workloads. The facility will be designed,

built and certified to Leadership in Energy and Environmental Design standards, incorporating energy and water-efficient solutions to optimise the use of resources.

>> Continua a leggere

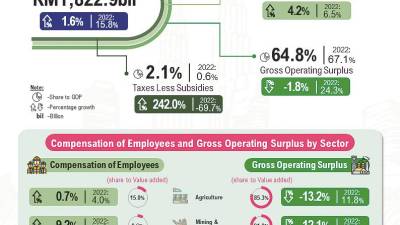

Malaysia’s nominal GDP in 2023 amounts to RM1.8 trillion (gio, 25 lug 2024)

PETALING JAYA: Malaysia’s nominal gross domestic product (GDP) amounted to RM1.8 trillion in 2023, growing 1.6% compared to 15.8% in the previous year, Chief Statistician Malaysia Datuk

Seri Dr Mohd Uzir Mahidin said today.

Despite the moderated performance, he said, the economy remained resilient particularly through private final consumption expenditure that increased 6.7%. The growth, he added, was propelled by

ongoing enhancement in employment and wage through the implementation of new minimum wage of RM1,500 a month which started in May 2023.

Given the improvements in the labour market, compensation of employees (CE) recorded a steady growth of 4.2% while gross operating surplus (GOS) declined by 1.8%. The performance of the income

distribution showed a shift towards a better share of CE at 33.1% compared to 32.3% in 2022, Mohd Uzir said.

Nevertheless, GOS still contributed substantially to GDP at 64.8% although it was 2.3% lower than the previous year. The remaining component was taxes less subsidies on production and imports (net

taxes), which accounted for 2.1%.

Looking at detailed sectoral performance, the increase in the CE component, encompassing the remuneration received by employees for their labour was driven by the services, manufacturing and

construction sectors. CE in services sector grew 4.3%, supported by growth in all sub-sectors, particularly wholesale and retail trade, food & beverages and accommodation.

The manufacturing sector CE registered 3.3% growth, led by the moderation in electrical, electronic and optical products. Furthermore, CE in construction and mining & quarrying sectors rose

6.8% and 9.2%, respectively, while CE in agriculture sector showed a marginal increase of 0.7% in 2023.

The services sector was the largest contributor to the CE, represented 62.5%, followed by the manufacturing sector with 23.6% share. Collectively, these sectors made up 86.1% of overall CE,

reflecting a significant role in the economy.

While, the construction and agriculture sectors accounted for 8.1% and 3.5%, respectively. The mining & quarrying sector contributed the smallest share, 2.2% of total CE.

Mohd Uzir said the decline in GOS was primarily influenced by a sharp downturn in mining & quarrying (-12.1%), agriculture (-13.2%) and manufacturing (-5.6%) sectors.

The fall of commodity prices in 2023 has lowered profitability across these sectors, leading to a marked decrease in overall GOS. Nevertheless, the contraction was partially alleviated by the

growth in the services and construction sectors at 5.3% and 1.3%, respectively.

In terms of composition of GOS, the services sector led with a 52.9% share, followed by the manufacturing sector at 23.3%. The mining & quarrying and agriculture sectors made up 12.0% and

10.2%, respectively. Meanwhile, the construction sector accounted for 1.6% of GOS in 2023.

Net taxes, a component which represents the source of income for the government, showed remarkable growth of 242% or RM37.7 billion in 2023, attributed to the higher taxation revenue as compared

to a decrease in subsidies.

Taxes on production and imports increased by 3.1%, driven by the growth in services tax and import duty. Meanwhile, a significant drop in subsidies, at 34.2% was mainly influenced by the decline

in petroleum and diesel subsidies.

In the context of international comparison, the composition of CE in the Southeast Asian region is notably lower, accounting for less than 40% of GDP, while GOS makes up a larger share.

PETALING JAYA: Malaysia’s nominal gross domestic product (GDP) amounted to RM1.8 trillion in 2023, growing 1.6% compared to 15.8% in the previous year, Chief Statistician Malaysia Datuk

Seri Dr Mohd Uzir Mahidin said today.

Despite the moderated performance, he said, the economy remained resilient particularly through private final consumption expenditure that increased 6.7%. The growth, he added, was propelled by

ongoing enhancement in employment and wage through the implementation of new minimum wage of RM1,500 a month which started in May 2023.

Given the improvements in the labour market, compensation of employees (CE) recorded a steady growth of 4.2% while gross operating surplus (GOS) declined by 1.8%. The performance of the income

distribution showed a shift towards a better share of CE at 33.1% compared to 32.3% in 2022, Mohd Uzir said.

Nevertheless, GOS still contributed substantially to GDP at 64.8% although it was 2.3% lower than the previous year. The remaining component was taxes less subsidies on production and imports (net

taxes), which accounted for 2.1%.

Looking at detailed sectoral performance, the increase in the CE component, encompassing the remuneration received by employees for their labour was driven by the services, manufacturing and

construction sectors. CE in services sector grew 4.3%, supported by growth in all sub-sectors, particularly wholesale and retail trade, food & beverages and accommodation.

The manufacturing sector CE registered 3.3% growth, led by the moderation in electrical, electronic and optical products. Furthermore, CE in construction and mining & quarrying sectors rose

6.8% and 9.2%, respectively, while CE in agriculture sector showed a marginal increase of 0.7% in 2023.

The services sector was the largest contributor to the CE, represented 62.5%, followed by the manufacturing sector with 23.6% share. Collectively, these sectors made up 86.1% of overall CE,

reflecting a significant role in the economy.

While, the construction and agriculture sectors accounted for 8.1% and 3.5%, respectively. The mining & quarrying sector contributed the smallest share, 2.2% of total CE.

Mohd Uzir said the decline in GOS was primarily influenced by a sharp downturn in mining & quarrying (-12.1%), agriculture (-13.2%) and manufacturing (-5.6%) sectors.

The fall of commodity prices in 2023 has lowered profitability across these sectors, leading to a marked decrease in overall GOS. Nevertheless, the contraction was partially alleviated by the

growth in the services and construction sectors at 5.3% and 1.3%, respectively.

In terms of composition of GOS, the services sector led with a 52.9% share, followed by the manufacturing sector at 23.3%. The mining & quarrying and agriculture sectors made up 12.0% and

10.2%, respectively. Meanwhile, the construction sector accounted for 1.6% of GOS in 2023.

Net taxes, a component which represents the source of income for the government, showed remarkable growth of 242% or RM37.7 billion in 2023, attributed to the higher taxation revenue as compared

to a decrease in subsidies.

Taxes on production and imports increased by 3.1%, driven by the growth in services tax and import duty. Meanwhile, a significant drop in subsidies, at 34.2% was mainly influenced by the decline

in petroleum and diesel subsidies.

In the context of international comparison, the composition of CE in the Southeast Asian region is notably lower, accounting for less than 40% of GDP, while GOS makes up a larger share.

>> Continua a leggere

Sime Darby, Porsche expand assembly facility in Kulim (mer, 24 lug 2024)

PETALING JAYA: Sime Darby Bhd and Porsche have jointly announced the expansion of Porsche’s assembly facility at Inokom, Sime Darby’s motor vehicle production and assembly facility in

Kulim, Kedah.

The local assembly facility has been expanded to 11,000 sq m to accommodate the increased capacity and introduction of a new assembly line for a second model variant, the plug-in hybrid Porsche

Cayenne S E-Hybrid Coupé. The new model variant is the first locally assembled Porsche to be exported to the Thailand market.

Sime Darby Group CEO Datuk Jeffri Salim Davidson said, “This is a significant milestone for us at Sime Darby together with our partner Porsche, in unlocking new opportunities in the Asean region

while affirming the capabilities of our highly skilled local talents. We remain steadfast in our commitment to delivering product consistency that meets the discerning demands of Porsche customers,

expanding beyond domestic market to our neighbouring country, Thailand.”

The local assembly facility for Porsche was the first of its kind outside of Europe when it was successfully opened in 2022.

Yesterday, the local assembly facility had rolled out two generations and more than 2,000 units of Porsche’s iconic sports car for five – and it is now ready for its next phase with the assembly

of its first PHEV variant and export into Thailand.

Porsche AG member of the executive board for production Albrecht Reimold said: “Porsche broke new ground when it established a local assembly facility in Malaysia in 2022. Since then, we have

achieved many significant milestones, for example when more than 2,000 locally assembled Cayennes found new homes with Malaysian families just two years after assembly commenced. Today, we prepare

for the future by considerably enhancing our site in Kulim, making sure that this first regionally exported Cayenne fulfils our customers’ demands and expectations.”

PETALING JAYA: Sime Darby Bhd and Porsche have jointly announced the expansion of Porsche’s assembly facility at Inokom, Sime Darby’s motor vehicle production and assembly facility in

Kulim, Kedah.

The local assembly facility has been expanded to 11,000 sq m to accommodate the increased capacity and introduction of a new assembly line for a second model variant, the plug-in hybrid Porsche

Cayenne S E-Hybrid Coupé. The new model variant is the first locally assembled Porsche to be exported to the Thailand market.

Sime Darby Group CEO Datuk Jeffri Salim Davidson said, “This is a significant milestone for us at Sime Darby together with our partner Porsche, in unlocking new opportunities in the Asean region

while affirming the capabilities of our highly skilled local talents. We remain steadfast in our commitment to delivering product consistency that meets the discerning demands of Porsche customers,

expanding beyond domestic market to our neighbouring country, Thailand.”

The local assembly facility for Porsche was the first of its kind outside of Europe when it was successfully opened in 2022.

Yesterday, the local assembly facility had rolled out two generations and more than 2,000 units of Porsche’s iconic sports car for five – and it is now ready for its next phase with the assembly

of its first PHEV variant and export into Thailand.

Porsche AG member of the executive board for production Albrecht Reimold said: “Porsche broke new ground when it established a local assembly facility in Malaysia in 2022. Since then, we have

achieved many significant milestones, for example when more than 2,000 locally assembled Cayennes found new homes with Malaysian families just two years after assembly commenced. Today, we prepare

for the future by considerably enhancing our site in Kulim, making sure that this first regionally exported Cayenne fulfils our customers’ demands and expectations.”

>> Continua a leggere

Honda Malaysia celebrates delivery milestones (mer, 24 lug 2024)

KLANG: Honda Malaysia yesterday reached a historic milestone with the delivery of the 170,000th Civic and the 150,000th HR-V in Malaysia.

To celebrate this double joy, the company hosted a special car handover ceremony at Honda Botanic Auto Mall Sdn Bhd to commemorate the achievements with the owners of these popular models.

Honda Malaysia managing director and CEO Hironobu Yoshimura said Honda models continue to receive growing popularity and demand, thanks to their customers’ support.

“Now in its 11th Generation, the Civic is an iconic Honda model and has maintained its position as the non-national C-segment leader for eight consecutive years since 2016. The HR-V meanwhile, has

won the hearts of many Malaysians since its debut in Malaysia nine years ago and set a high benchmark in the compact SUV segment. With its exceptional design and advanced powertrain options, we

believe the HR-V will continue to be Malaysian’s favourite compact SUV. As we celebrate the delivery of the 170,000th Civic and 150,000th HR-V, we extend our sincere gratitude to both our customers

for being part of Honda’s journey and helping us in achieving this significant milestone,” he added.

The 170,000th Civic is a 2.0L e:HEV RS, while the 150,000th HR-V is a 1.5L e:HEV RS. Both models were delivered to their respective owners – Lim Chin Hui and Asha Waheda during the handover

ceremony. As a gesture of appreciation to mark the occasion, both owners were presented with an exclusive gift and Honda genuine accessories worth RM10,000.

In the first half of 2024, the company recorded total sales of more than 39,200 units, representing a 16% growth from the corresponding period in 2023. The HR-V, which is the most sought-after

model in the non-national compact SUV segment, is the biggest contributor with a 28% contribution to Honda Malaysia’s total sales. The second best-selling model is the City, accounting for 24% of the

total sales, followed by the CR-V with a 15% contribution.

The company also saw a rising demand for the e:HEV technology. Offered in models such as the City, City Hatchback, Civic, HR-V and CR-V, Honda Malaysia further strengthens the presence of the

e:HEV technology in the industry. The e:HEV variants contributed 13% to Honda Malaysia’s sales in the first half of 2024, marking substantial growth for Honda’s hybrid models.

KLANG: Honda Malaysia yesterday reached a historic milestone with the delivery of the 170,000th Civic and the 150,000th HR-V in Malaysia.

To celebrate this double joy, the company hosted a special car handover ceremony at Honda Botanic Auto Mall Sdn Bhd to commemorate the achievements with the owners of these popular models.

Honda Malaysia managing director and CEO Hironobu Yoshimura said Honda models continue to receive growing popularity and demand, thanks to their customers’ support.

“Now in its 11th Generation, the Civic is an iconic Honda model and has maintained its position as the non-national C-segment leader for eight consecutive years since 2016. The HR-V meanwhile, has

won the hearts of many Malaysians since its debut in Malaysia nine years ago and set a high benchmark in the compact SUV segment. With its exceptional design and advanced powertrain options, we

believe the HR-V will continue to be Malaysian’s favourite compact SUV. As we celebrate the delivery of the 170,000th Civic and 150,000th HR-V, we extend our sincere gratitude to both our customers

for being part of Honda’s journey and helping us in achieving this significant milestone,” he added.

The 170,000th Civic is a 2.0L e:HEV RS, while the 150,000th HR-V is a 1.5L e:HEV RS. Both models were delivered to their respective owners – Lim Chin Hui and Asha Waheda during the handover

ceremony. As a gesture of appreciation to mark the occasion, both owners were presented with an exclusive gift and Honda genuine accessories worth RM10,000.

In the first half of 2024, the company recorded total sales of more than 39,200 units, representing a 16% growth from the corresponding period in 2023. The HR-V, which is the most sought-after

model in the non-national compact SUV segment, is the biggest contributor with a 28% contribution to Honda Malaysia’s total sales. The second best-selling model is the City, accounting for 24% of the

total sales, followed by the CR-V with a 15% contribution.

The company also saw a rising demand for the e:HEV technology. Offered in models such as the City, City Hatchback, Civic, HR-V and CR-V, Honda Malaysia further strengthens the presence of the

e:HEV technology in the industry. The e:HEV variants contributed 13% to Honda Malaysia’s sales in the first half of 2024, marking substantial growth for Honda’s hybrid models.

>> Continua a leggere

Price index of cement higher in June: DoSM (mer, 24 lug 2024)

PUTRAJAYA: The unit price index of cement recorded in June this year increased between 0.1% and 2.1% in Peninsular Malaysia, Sabah, and Sarawak.

The highest increase was in Selangor, Kuala Lumpur, Malacca, and Negri Sembilan (2.1%), followed by Pahang (1.6%) and Kuching (0.1%), according to a report entitled Special For Building And

Structural Works released by the Department of Statistics Malaysia (DoSM).

In a statement, Chief Statistician Datuk Seri Dr Mohd Uzir Mahidin said the aggregates’ unit price index registered an increase between 0.4% and 0.6% for almost all areas in June 2024 compared to

the previous month.

The highest increase was recorded in Penang, Kedah, Perlis and Kota Kinabalu (0.6% respectively).

Mohd Uzir also mentioned that the monthly comparison showed a slight increase in the unit price index of steel for several areas.

The highest increases were in Sibu (0.4%), Kota Kinabalu (0.2%), and Penang, Kedah, and Perlis (0.1%).

Meanwhile, the unit price index of materials decreased in Selangor, Kuala Lumpur, Malacca and Negri Sembilan (-0.8%), followed by Terengganu & Kelantan (-0.1%).

The monthly comparison of steel and metal sections showed that the unit price index remained unchanged in June 2024 in Peninsular Malaysia, Sabah, and Sarawak.

However, there was a slight decrease in these materials’ price index in Penang, Kedah and Perlis (-0.7%), followed by Kuching (-0.6%) and Kota Kinabalu (-0.2%).

An annual comparison for the period of June 2023 and June 2024 showed that the unit price index of cement increased between 0.4% and 4.7% for all areas in Peninsular Malaysia, Sabah and

Sarawak.

The highest increase was recorded in Selangor, Kuala Lumpur, Malacca and Negri Sembilan (4.7%), followed by Tawau (2.2%), Penang, Kedah and Perlis (2%) and Pahang (1.6%).

An annual comparison of the average price per unit of steel decreased from -0.1% to -5.3% in June 2024 compared to the same month last year for almost all areas in Peninsular Malaysia, Sabah and

Sarawak.

However, the material price index increased slightly in Kuching (0.5%) and Johor (0.7%).

Mohd Uzir elaborated that the average price of cement (Ordinary Portland) recorded a marginal increase (0.3%) with an average price of RM23.10 per 50kg bag as compared to May 2024 (RM23.04 per

50kg bag).

Meanwhile, the average price per unit of steel, consisting of mild steel round bars and Mycon 60 high tensile deformed bars, remained unchanged compared to May 2024, with an average price of

RM3,730.49 per tonne.

In June 2024, the month-on-month BCI with steel bars for all building categories increased between 0.1% and 2% for almost all areas in Peninsular Malaysia.

The highest increase was in Selangor, Kuala Lumpur, Malacca and Negri Sembilan for the timber piling category (2%).

However, there was a slight decrease between -0.1% to -0.3% for BCI with steel bars for several building categories in Johor, Terengganu and Kelantan.

BCI with steel bars in Sabah also showed a slight increase of 0.1% for almost all building categories in Kota Kinabalu and Tawau.

Meanwhile, the index for almost all other building categories in Sandakan remained unchanged.

A monthly comparison of BCI with steel bars in Sarawak registered a slight decrease between -0.1% to -0.2% in June 2024 for almost all categories of buildings in Kuching.

PUTRAJAYA: The unit price index of cement recorded in June this year increased between 0.1% and 2.1% in Peninsular Malaysia, Sabah, and Sarawak.

The highest increase was in Selangor, Kuala Lumpur, Malacca, and Negri Sembilan (2.1%), followed by Pahang (1.6%) and Kuching (0.1%), according to a report entitled Special For Building And

Structural Works released by the Department of Statistics Malaysia (DoSM).

In a statement, Chief Statistician Datuk Seri Dr Mohd Uzir Mahidin said the aggregates’ unit price index registered an increase between 0.4% and 0.6% for almost all areas in June 2024 compared to

the previous month.

The highest increase was recorded in Penang, Kedah, Perlis and Kota Kinabalu (0.6% respectively).

Mohd Uzir also mentioned that the monthly comparison showed a slight increase in the unit price index of steel for several areas.

The highest increases were in Sibu (0.4%), Kota Kinabalu (0.2%), and Penang, Kedah, and Perlis (0.1%).

Meanwhile, the unit price index of materials decreased in Selangor, Kuala Lumpur, Malacca and Negri Sembilan (-0.8%), followed by Terengganu & Kelantan (-0.1%).

The monthly comparison of steel and metal sections showed that the unit price index remained unchanged in June 2024 in Peninsular Malaysia, Sabah, and Sarawak.

However, there was a slight decrease in these materials’ price index in Penang, Kedah and Perlis (-0.7%), followed by Kuching (-0.6%) and Kota Kinabalu (-0.2%).

An annual comparison for the period of June 2023 and June 2024 showed that the unit price index of cement increased between 0.4% and 4.7% for all areas in Peninsular Malaysia, Sabah and

Sarawak.

The highest increase was recorded in Selangor, Kuala Lumpur, Malacca and Negri Sembilan (4.7%), followed by Tawau (2.2%), Penang, Kedah and Perlis (2%) and Pahang (1.6%).

An annual comparison of the average price per unit of steel decreased from -0.1% to -5.3% in June 2024 compared to the same month last year for almost all areas in Peninsular Malaysia, Sabah and

Sarawak.

However, the material price index increased slightly in Kuching (0.5%) and Johor (0.7%).

Mohd Uzir elaborated that the average price of cement (Ordinary Portland) recorded a marginal increase (0.3%) with an average price of RM23.10 per 50kg bag as compared to May 2024 (RM23.04 per

50kg bag).

Meanwhile, the average price per unit of steel, consisting of mild steel round bars and Mycon 60 high tensile deformed bars, remained unchanged compared to May 2024, with an average price of

RM3,730.49 per tonne.

In June 2024, the month-on-month BCI with steel bars for all building categories increased between 0.1% and 2% for almost all areas in Peninsular Malaysia.

The highest increase was in Selangor, Kuala Lumpur, Malacca and Negri Sembilan for the timber piling category (2%).

However, there was a slight decrease between -0.1% to -0.3% for BCI with steel bars for several building categories in Johor, Terengganu and Kelantan.

BCI with steel bars in Sabah also showed a slight increase of 0.1% for almost all building categories in Kota Kinabalu and Tawau.

Meanwhile, the index for almost all other building categories in Sandakan remained unchanged.

A monthly comparison of BCI with steel bars in Sarawak registered a slight decrease between -0.1% to -0.2% in June 2024 for almost all categories of buildings in Kuching.

>> Continua a leggere

Malaysia has made great progress in attracting tech investments: 500 Global head (mer, 24 lug 2024)

KUALA LUMPUR: Malaysia recorded a total of 9.48 million visitors from January to May this year, an increase of two million visitors compared to the same period in 2023.

500 Global managing partner Khailee Ng said tourist arrivals to Malaysia are increasing, highlighting why major global corporations such as Microsoft, Cloud AI and Infineon choose to invest in the

country.

He said the nation has made significant progress by having the world’s largest production site of silicon carbides, with Infineon recording up to RM22.8 billion (US$5 billion).

“There are also projects from China, Europe, the United States, and other countries that are being set up not just in Penang but also in Johor, Sabah and Sarawak.

“Events like this will also bring the community into the opportunities and insights of the Malaysian investments,“ he said in his speech at the opening of the Tech in Asia Conference 2024

today.

The two-day conference, powered by Mystartup by Cradle, as attracted tech enthusiasts, investors and entrepreneurs from across Southeast Asia. The event , underpinned by Mystartup’s commitment to

fostering startup growth and innovation, is a pivotal moment for the region’s tech ecosystem.

The conference opened with a keynote address by Cradle Fund Sdn Bhd CEO Datuk Seri Mohd Yusof Sulaiman, who highlighted the transformative impact of startups on the Malaysian economy. “The role of

Mystartup by Cradle is key in nurturing homegrown talent and supporting scalable business models through funding, mentorship and market access,“ he said.

Malaysia Semiconductor Industry Association president Datuk Seri Wong Siew Hai shared his insights on Malaysia’s semiconductors opportunity, which focuses on leveraging opportunities to enhance

the industry and localising semiconductors in the Malaysian industry.

The conference features panel sessions and workshops addressing critical issues in the tech industry.

Sessions such as “Scaling Startups in Southeast Asia” and “The Rise of Malaysia Fintech Scene” provided valuable insights into market trends, regulatory challenges and growth strategies.

A recurring theme at the conference is the emphasis on sustainability, opportunities and inclusivity in technology. –

KUALA LUMPUR: Malaysia recorded a total of 9.48 million visitors from January to May this year, an increase of two million visitors compared to the same period in 2023.

500 Global managing partner Khailee Ng said tourist arrivals to Malaysia are increasing, highlighting why major global corporations such as Microsoft, Cloud AI and Infineon choose to invest in the

country.

He said the nation has made significant progress by having the world’s largest production site of silicon carbides, with Infineon recording up to RM22.8 billion (US$5 billion).

“There are also projects from China, Europe, the United States, and other countries that are being set up not just in Penang but also in Johor, Sabah and Sarawak.

“Events like this will also bring the community into the opportunities and insights of the Malaysian investments,“ he said in his speech at the opening of the Tech in Asia Conference 2024

today.

The two-day conference, powered by Mystartup by Cradle, as attracted tech enthusiasts, investors and entrepreneurs from across Southeast Asia. The event , underpinned by Mystartup’s commitment to

fostering startup growth and innovation, is a pivotal moment for the region’s tech ecosystem.

The conference opened with a keynote address by Cradle Fund Sdn Bhd CEO Datuk Seri Mohd Yusof Sulaiman, who highlighted the transformative impact of startups on the Malaysian economy. “The role of

Mystartup by Cradle is key in nurturing homegrown talent and supporting scalable business models through funding, mentorship and market access,“ he said.

Malaysia Semiconductor Industry Association president Datuk Seri Wong Siew Hai shared his insights on Malaysia’s semiconductors opportunity, which focuses on leveraging opportunities to enhance

the industry and localising semiconductors in the Malaysian industry.

The conference features panel sessions and workshops addressing critical issues in the tech industry.

Sessions such as “Scaling Startups in Southeast Asia” and “The Rise of Malaysia Fintech Scene” provided valuable insights into market trends, regulatory challenges and growth strategies.

A recurring theme at the conference is the emphasis on sustainability, opportunities and inclusivity in technology. –

>> Continua a leggere

MN Holdings secures RM136.2m substation engineering contract for data centre in Johor (mer, 24 lug 2024)

PETALING JAYA: Underground utilities and substation engineering specialist MN Holdings Berhad has secured a substation engineering contract worth RM136.2 million in Johor.

The company’s wholly owned subsidiary MN Power Transmission Sdn Bhd (MN Power) received and accepted a letter of award from a customer that provides data centre services (Customer A).

The contract scope of work comprises design, supply, installation, maintenance, testing and commissioning for a new 275 kilovolt (kV) consumer landing station (CLS), including main building works,

guardhouse and external works, and dismantling and relocating the existing 33/11kV Containerised CLS to the new 33/11kV Interim CLS for Customer A under Package 2.

The latest contract win is in addition to a previous contract won under Package 1 to perform earthworks, retaining walls and piling works for the same CLS, with a contract sum of RM7.1

million.

The contract shall commence in July 2024 and target for completion by June 2025.

MN Holdings executive director Datuk Dang Siong Diang said with more data centres in the pipeline in Johor and Selangor, the company is prepared to bid for more projects in the data centre

category.

“We don’t see a slowdown in power infrastructure projects in the coming years as Malaysia has attracted more than 50 data centres within the last two years, putting it on track to become a new

data centre hub in South-East Asia.

“Inclusive of the latest contract win, in total, MN Holdings has clinched RM291.5 million worth of on-going data centre contracts that will keep the Company busy for the next two years. Apart from

contracts from data centres, the company also secured projects from large scale solar (LSS) project owners. In the second quarter, the company had bagged an engineering, procurement, construction and

commissioning (EPCC) contract for a LSS photovoltaic plant in Kedah with contract sum of RM26.0 million, as well as a contract worth RM1.26 million to supply, deliver, install, testing and

commissioning solar photovoltaic system for the rehabilitation works of four solar hybrid stations at Perak, Kelantan and Johor” he added.

Moving forward, MN Holdings expects its performance to be bolstered by both ongoing projects and new projects that are expected to be secured. In addition to its involvement in the power industry,

MN Holdings is also actively participating in upgrading water and sewerage infrastructure. This sector is driven by the government’s focus on addressing non-revenue water challenges and the

increasing demand for water to support the data centre industry.

Recently, MN Semantra Sdn Bhd, a subsidiary company of MN Holdings had secured a RM13.0 million contract for drainage and sewerage works for flood mitigation using the pipe jacking method at

Seremban.

With the latest job win, its outstanding order book increased to a total value of RM568.5 million, which is expected to be progressively completed between 2024 and 2025. Out of the RM568.5 million

order book, RM546.7 million are projects from the power and gas industries while the remaining RM21.8 million from the water and sewerage industry.

PETALING JAYA: Underground utilities and substation engineering specialist MN Holdings Berhad has secured a substation engineering contract worth RM136.2 million in Johor.

The company’s wholly owned subsidiary MN Power Transmission Sdn Bhd (MN Power) received and accepted a letter of award from a customer that provides data centre services (Customer A).

The contract scope of work comprises design, supply, installation, maintenance, testing and commissioning for a new 275 kilovolt (kV) consumer landing station (CLS), including main building works,

guardhouse and external works, and dismantling and relocating the existing 33/11kV Containerised CLS to the new 33/11kV Interim CLS for Customer A under Package 2.

The latest contract win is in addition to a previous contract won under Package 1 to perform earthworks, retaining walls and piling works for the same CLS, with a contract sum of RM7.1

million.

The contract shall commence in July 2024 and target for completion by June 2025.

MN Holdings executive director Datuk Dang Siong Diang said with more data centres in the pipeline in Johor and Selangor, the company is prepared to bid for more projects in the data centre

category.

“We don’t see a slowdown in power infrastructure projects in the coming years as Malaysia has attracted more than 50 data centres within the last two years, putting it on track to become a new

data centre hub in South-East Asia.

“Inclusive of the latest contract win, in total, MN Holdings has clinched RM291.5 million worth of on-going data centre contracts that will keep the Company busy for the next two years. Apart from

contracts from data centres, the company also secured projects from large scale solar (LSS) project owners. In the second quarter, the company had bagged an engineering, procurement, construction and

commissioning (EPCC) contract for a LSS photovoltaic plant in Kedah with contract sum of RM26.0 million, as well as a contract worth RM1.26 million to supply, deliver, install, testing and

commissioning solar photovoltaic system for the rehabilitation works of four solar hybrid stations at Perak, Kelantan and Johor” he added.

Moving forward, MN Holdings expects its performance to be bolstered by both ongoing projects and new projects that are expected to be secured. In addition to its involvement in the power industry,

MN Holdings is also actively participating in upgrading water and sewerage infrastructure. This sector is driven by the government’s focus on addressing non-revenue water challenges and the

increasing demand for water to support the data centre industry.

Recently, MN Semantra Sdn Bhd, a subsidiary company of MN Holdings had secured a RM13.0 million contract for drainage and sewerage works for flood mitigation using the pipe jacking method at

Seremban.

With the latest job win, its outstanding order book increased to a total value of RM568.5 million, which is expected to be progressively completed between 2024 and 2025. Out of the RM568.5 million

order book, RM546.7 million are projects from the power and gas industries while the remaining RM21.8 million from the water and sewerage industry.

>> Continua a leggere

AME Elite and AME REIT announce RM119.5m industrial properties transaction in Iskandar Malaysia (mer, 24 lug 2024)

JOHOR BAHRU: AME Elite Consortium Berhad and I REIT Managers Sdn Bhd, the management company of AME Real Estate Investment Trust (AME REIT), jointly announced the proposed transaction of four

fully-leased industrial properties in Iskandar Malaysia worth RM119.5 million; AME REIT will acquire these properties from its sponsor AME Elite for cash considerations.

The four properties — two located in i-TechValley and two in i-Park@Senai Airport City — have a combined agreed lettable area (ALA) of 391,872 square feet (sq. ft.). The properties consist of

single-story detached factories with mezzanine offices and ancillary buildings, currently leased to reputable tenants.

AME Elite Consortium Berhad executive director and Group CEO Dylan Tan Teck Eng said, “Malaysia’s improving economy and increasing foreign direct investment (FDI) in the industrial sector,

particularly in Iskandar Malaysia where our industrial parks are strategically located, present significant advantages and growth opportunities.

Our strategic partnership with AME REIT, which includes its right of first refusal for AME Elite-owned properties for five years after AME REIT’s listing in 2022, allows us to capitalise on the

favourable market potential created by higher FDI.

Furthermore, divesting properties to AME REIT enables us to optimise our capital allocation towards further expansion of our industrial parks, while our tenants benefit from the expertise of a

dedicated industrial REIT team in managing their long-term needs. This mutually beneficial arrangement ensures a steady pipeline of potential assets for AME REIT and aligns our interests for mutual

growth.”

The proceeds from AME Elite’s divestment will partially fund the ongoing development of its i-TechValley project in SILC, a 169.8-acre industrial park with an estimated gross development value

(GDV) of RM1.5 billion. Remaining proceeds will also be allocated towards future industrial property development and investment projects, including land acquisitions and joint ventures.

The transaction is expected to generate a pro forma gain on disposal of approximately RM22.9 million for AME Elite, net of tax and minority interest, resulting in an illustrative 24.1% increase in

earnings per share to 18.08 sen from 14.57 sen for the financial year ended March 31, 2024.

I REIT Managers Sdn Bhd CEO and executive director Chan Wai Leo said, “The acquisitions of industrial properties from our sponsor underscores our continued efforts to expand our portfolio and

reward our unitholders with growth in income distribution.

The exercise will further strengthen our position as a prominent industrial-focused REIT, with an expanded portfolio of 41 industrial and industrial-related properties. This acquisition drive, our

second since listing, will enhance our financial performance in FY2025 and beyond.

In addition to purchasing properties from our sponsor, our acquisition strategy also encompasses identifying compatible third-party assets in the central and northern regions of Peninsular

Malaysia.”

The acquisitions will increase AME REIT’s pro forma total asset value by 16.7% to RM828.8 million from RM710.2 million as at March 31, 2024, and its ALA by 20.9% to 2.3 million sq. ft. from 1.9

million sq. ft. If the proposed acquisitions are fully financed via Islamic financing facilities, AME REIT’s pro forma gearing ratio is estimated to increase to 27.0%.

All properties are fully leased to tenants such as Ametalin Sdn Bhd, AAC Technologies (Malaysia) Sdn Bhd, Resmed Malaysia Operations Sdn Bhd, and a healthcare-related manufacturer, with long-term

leases ranging from 5 to 10 years, with renewal options. The diverse tenant mix of the acquired properties further enhances the stability and resilience of AME REIT’s portfolio, ensuring a steady

income flow and potential for increased distributions to unitholders.

The transaction is structured as a sale and purchase agreement between RHB Trustees Berhad, the trustee of AME REIT, and subsidiaries of AME Elite, with the purchase consideration settled entirely

in cash. The transaction is expected to be completed in phases between the first and third quarters of 2025.

The acquisitions are subject to approvals from non-interested unitholders of AME REIT and non-interested shareholders of AME Elite at their respective Extraordinary General Meetings, as well as

relevant regulatory bodies. The transaction is expected to contribute positively to earnings of AME REIT and AME Elite in the financial year ending March 31, 2025 (FY2025) and beyond.

The latest transaction marks AME REIT’s second acquisition from AME Elite, following its initial post-listing purchase of three industrial properties in Iskandar Malaysia from AME Elite for RM69.3

million in October 2023.

JOHOR BAHRU: AME Elite Consortium Berhad and I REIT Managers Sdn Bhd, the management company of AME Real Estate Investment Trust (AME REIT), jointly announced the proposed transaction of four

fully-leased industrial properties in Iskandar Malaysia worth RM119.5 million; AME REIT will acquire these properties from its sponsor AME Elite for cash considerations.

The four properties — two located in i-TechValley and two in i-Park@Senai Airport City — have a combined agreed lettable area (ALA) of 391,872 square feet (sq. ft.). The properties consist of

single-story detached factories with mezzanine offices and ancillary buildings, currently leased to reputable tenants.

AME Elite Consortium Berhad executive director and Group CEO Dylan Tan Teck Eng said, “Malaysia’s improving economy and increasing foreign direct investment (FDI) in the industrial sector,

particularly in Iskandar Malaysia where our industrial parks are strategically located, present significant advantages and growth opportunities.

Our strategic partnership with AME REIT, which includes its right of first refusal for AME Elite-owned properties for five years after AME REIT’s listing in 2022, allows us to capitalise on the

favourable market potential created by higher FDI.

Furthermore, divesting properties to AME REIT enables us to optimise our capital allocation towards further expansion of our industrial parks, while our tenants benefit from the expertise of a

dedicated industrial REIT team in managing their long-term needs. This mutually beneficial arrangement ensures a steady pipeline of potential assets for AME REIT and aligns our interests for mutual

growth.”

The proceeds from AME Elite’s divestment will partially fund the ongoing development of its i-TechValley project in SILC, a 169.8-acre industrial park with an estimated gross development value

(GDV) of RM1.5 billion. Remaining proceeds will also be allocated towards future industrial property development and investment projects, including land acquisitions and joint ventures.

The transaction is expected to generate a pro forma gain on disposal of approximately RM22.9 million for AME Elite, net of tax and minority interest, resulting in an illustrative 24.1% increase in

earnings per share to 18.08 sen from 14.57 sen for the financial year ended March 31, 2024.

I REIT Managers Sdn Bhd CEO and executive director Chan Wai Leo said, “The acquisitions of industrial properties from our sponsor underscores our continued efforts to expand our portfolio and

reward our unitholders with growth in income distribution.

The exercise will further strengthen our position as a prominent industrial-focused REIT, with an expanded portfolio of 41 industrial and industrial-related properties. This acquisition drive, our

second since listing, will enhance our financial performance in FY2025 and beyond.

In addition to purchasing properties from our sponsor, our acquisition strategy also encompasses identifying compatible third-party assets in the central and northern regions of Peninsular

Malaysia.”

The acquisitions will increase AME REIT’s pro forma total asset value by 16.7% to RM828.8 million from RM710.2 million as at March 31, 2024, and its ALA by 20.9% to 2.3 million sq. ft. from 1.9

million sq. ft. If the proposed acquisitions are fully financed via Islamic financing facilities, AME REIT’s pro forma gearing ratio is estimated to increase to 27.0%.

All properties are fully leased to tenants such as Ametalin Sdn Bhd, AAC Technologies (Malaysia) Sdn Bhd, Resmed Malaysia Operations Sdn Bhd, and a healthcare-related manufacturer, with long-term

leases ranging from 5 to 10 years, with renewal options. The diverse tenant mix of the acquired properties further enhances the stability and resilience of AME REIT’s portfolio, ensuring a steady

income flow and potential for increased distributions to unitholders.

The transaction is structured as a sale and purchase agreement between RHB Trustees Berhad, the trustee of AME REIT, and subsidiaries of AME Elite, with the purchase consideration settled entirely

in cash. The transaction is expected to be completed in phases between the first and third quarters of 2025.

The acquisitions are subject to approvals from non-interested unitholders of AME REIT and non-interested shareholders of AME Elite at their respective Extraordinary General Meetings, as well as

relevant regulatory bodies. The transaction is expected to contribute positively to earnings of AME REIT and AME Elite in the financial year ending March 31, 2025 (FY2025) and beyond.

The latest transaction marks AME REIT’s second acquisition from AME Elite, following its initial post-listing purchase of three industrial properties in Iskandar Malaysia from AME Elite for RM69.3

million in October 2023.

>> Continua a leggere

AME REIT reports 6.7% growth in net property income to RM11.4 million in 1Q25 (mer, 24 lug 2024)

JOHOR BAHRU: Industrial REIT AME Real Estate Investment Trust (AME REIT) recorded a 6.7% increase in net property income (NPI) to RM11.4 million in the first quarter ended June 30, 2024 (1Q25)

from RM10.7 million in the previous corresponding quarter (1Q24).

The growth was driven by a 8.2% rise in rental income to RM12.3 million from RM11.4 million previously, attributed to contribution from an industrial property acquired in October 2023, as well as

positive rental reversions achieved across AME REIT’s portfolio.

After accounting for non-property expenses, namely management fees, trustee’s fees, financing costs, and other adjustments, the total distributable income amounted to RM9.7 million in 1Q25 versus

RM9.4 million previously.

AME REIT will reward unitholders by distributing 99.9% of the total distributable income of RM9.7 million for 1Q25, equivalent to a distribution per unit (DPU) of 1.84 sen. The distribution is

payable on Aug 30, 2024 to unitholders of record as of Aug 8, 2024.

I REIT Managers Sdn Bhd CEO and executive director Chan Wai Leo said: “Our 1Q25 performance reflects our continued operational excellence and effective execution of strategic initiatives. Notably,

we maintained high occupancy across our portfolio and secured positive rental reversions on our lease renewals in the previous year, highlighting our resilient position in the Malaysian industrial

property market.”

Looking ahead, he added they are confident in the sustained growth potential of the Malaysian industrial sector, driven by increasing foreign direct investment and a stabilising ringgit.

“We remain focused on maximising long-term value for our unitholders through strategic acquisitions and effective asset management,” he said.

AME REIT’s current portfolio consists of 34 industrial properties with an agreed-upon lettable area of 1.9 million sq ft and 3 industrial-related properties of workers’ dormitories. As at June 30,

2024, AME REIT has RM686 million worth of properties under management.

AME REIT’s properties are mainly situated across three industrial parks of AME Group in Iskandar Malaysia, namely i-Park @ Indahpura in Kulai, i-Park @ Senai Airport City in Senai, and i-Park @

SILC in Iskandar Puteri.

JOHOR BAHRU: Industrial REIT AME Real Estate Investment Trust (AME REIT) recorded a 6.7% increase in net property income (NPI) to RM11.4 million in the first quarter ended June 30, 2024 (1Q25)

from RM10.7 million in the previous corresponding quarter (1Q24).

The growth was driven by a 8.2% rise in rental income to RM12.3 million from RM11.4 million previously, attributed to contribution from an industrial property acquired in October 2023, as well as

positive rental reversions achieved across AME REIT’s portfolio.

After accounting for non-property expenses, namely management fees, trustee’s fees, financing costs, and other adjustments, the total distributable income amounted to RM9.7 million in 1Q25 versus

RM9.4 million previously.

AME REIT will reward unitholders by distributing 99.9% of the total distributable income of RM9.7 million for 1Q25, equivalent to a distribution per unit (DPU) of 1.84 sen. The distribution is

payable on Aug 30, 2024 to unitholders of record as of Aug 8, 2024.

I REIT Managers Sdn Bhd CEO and executive director Chan Wai Leo said: “Our 1Q25 performance reflects our continued operational excellence and effective execution of strategic initiatives. Notably,

we maintained high occupancy across our portfolio and secured positive rental reversions on our lease renewals in the previous year, highlighting our resilient position in the Malaysian industrial

property market.”

Looking ahead, he added they are confident in the sustained growth potential of the Malaysian industrial sector, driven by increasing foreign direct investment and a stabilising ringgit.

“We remain focused on maximising long-term value for our unitholders through strategic acquisitions and effective asset management,” he said.

AME REIT’s current portfolio consists of 34 industrial properties with an agreed-upon lettable area of 1.9 million sq ft and 3 industrial-related properties of workers’ dormitories. As at June 30,

2024, AME REIT has RM686 million worth of properties under management.

AME REIT’s properties are mainly situated across three industrial parks of AME Group in Iskandar Malaysia, namely i-Park @ Indahpura in Kulai, i-Park @ Senai Airport City in Senai, and i-Park @

SILC in Iskandar Puteri.

>> Continua a leggere

Bank Negara, govt efforts to stabilise ringgit yielding results: Maybank IB (mer, 24 lug 2024)

KUALA LUMPUR: Efforts by Bank Negara Malaysia (BNM) to stabilise the ringgit and rebuild external reserves through repatriation and conversion are progressing positively.

Maybank Investment Bank Bhd (Maybank IB) group chief economist Suhaimi Ilias said government and central bank efforts to stabilise the local currency and rebuild reserves with support from

government-linked companies are also progressing.

“The improvement in the country’s current account surplus in the first quarter this year, compared to the fourth quarter of last year, was largely driven by higher inflows of investment income,”